News

April’s CPI Report Sparks Hope for 2024 Interest Rate Cuts

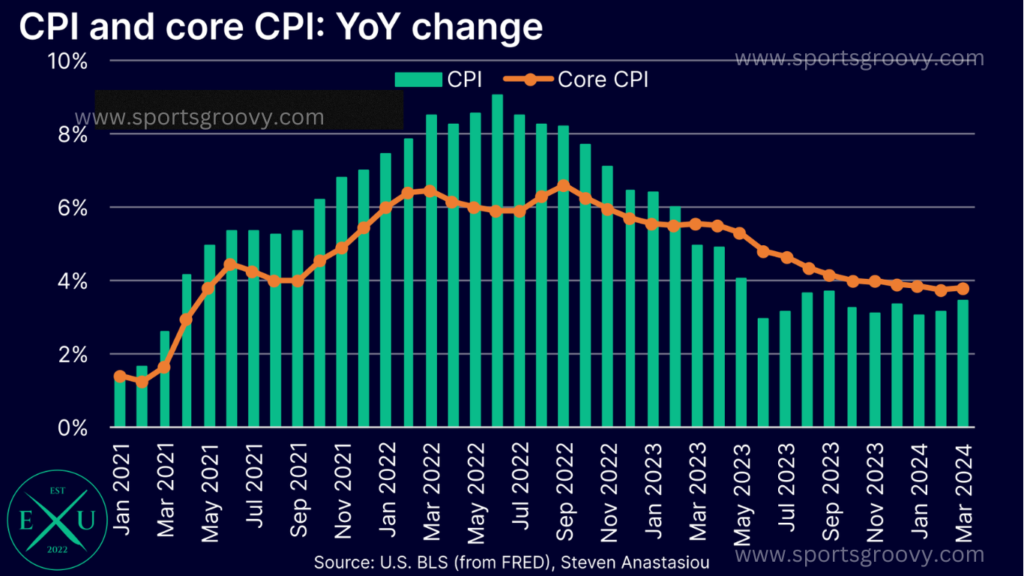

In April, the Consumer Price Index(CPI) data revealed a slowdown in core inflation, indicating a possible easing from the elevated levels seen in February and March. This suggests that prices for goods and services may not be rising as rapidly as before. However, compared to late 2023, inflation throughout 2024 still remains relatively high.

You will know here that how unfortunately a man loss in millions due to a single mistake.

On the retail front, sales cooled more than anticipated, reflecting a potential slowdown in consumer spending. This unexpected dip in retail activity could have implications for overall economic growth.

Following the release of the CPI data, the S&P 500 started Wednesday’s trading session on a positive note in the stock market. Investors seemed to be processing the information and considering its potential impact on the Federal Reserve’s stance on interest rates. There’s speculation about whether these developments might influence the Fed’s decision regarding future rate cuts.

Navigating Recent Inflation Trends:

April 2024 saw a 0.3% rise in the Consumer Price Index (CPI), holding steady at 0.3% when excluding food and energy. While this marks a slight decrease from the 0.4% monthly increases observed in February and March, it remains notably higher than the more modest inflation rates ranging from 0.1% to 0.2% seen frequently in the latter half of 2023.

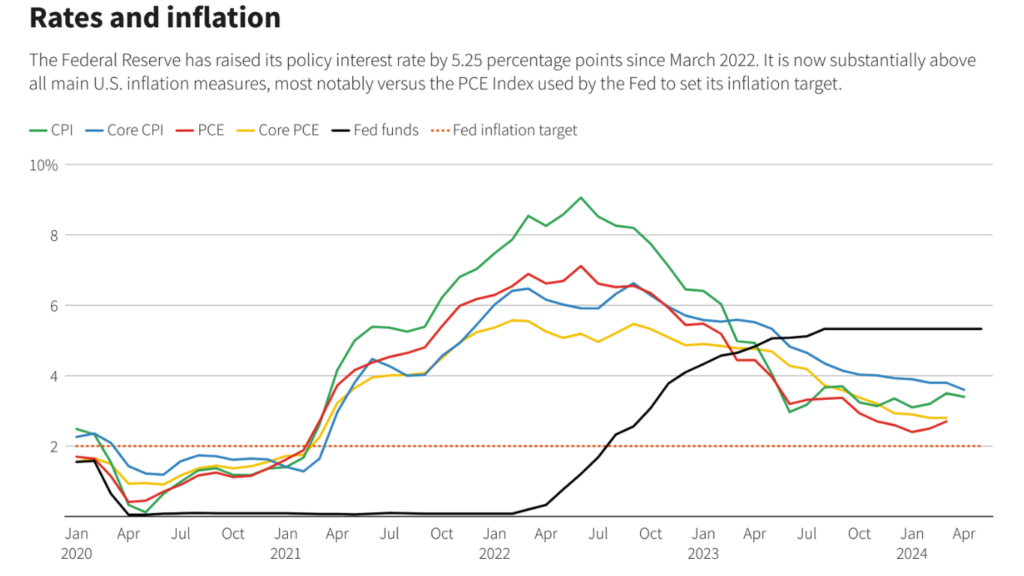

The Federal Open Market Committee (FOMC) maintains an annual inflation target of 2%. Translated into monthly terms, this target suggests an inflation rate just below 0.2% per month. While April’s figures signal some moderation in inflation compared to earlier months, they still surpass the target range set by the FOMC.

April’s inflation data offers a glimpse of potential improvement, yet it hasn’t quite aligned with the Federal Open Market Committee’s (FOMC) target. Notably, core inflation, which excludes volatile food and energy prices, dipped to a 3.6% annual rate by April 2024. This marks the lowest level for this metric since the surge in inflation began.

However, headline inflation paints a more varied picture, standing at 3.4% and remaining above levels observed at various points in 2023.

Core CPI inflation seems to be following a consistent downward trend, indicating some stability in underlying price pressures. On the other hand, headline inflation has largely moved sideways within a relatively narrow range since last summer, showing less decisive movement.

Understanding Inflation Components:

In April’s CPI report, the vital component of shelter didn’t show as much cooling as some had hoped for. It recorded a 0.4% increase for the month, aligning closely with trends from recent months and indicating a 5.5% annual growth rate. This persistent rise in shelter costs could impact overall inflation dynamics.

The hope among optimists was that a slowdown in shelter costs would provide momentum for inflation to approach the Federal Open Market Committee’s (FOMC) 2% target. However, with shelter expenses remaining robust, achieving that target might prove more challenging.

In other sectors, the trend of declining vehicle prices persists, while there have been price drops in food consumed away from home. These shifts indicate some relief in certain areas of consumer spending.

Overall, inflationary pressures are predominantly stemming from the services sector. Within transportation services, notable price hikes, particularly in car insurance, are contributing to this trend.

However, there are signs of moderation in prices within the medical and household services categories. These developments underscore the nuanced nature of inflation dynamics across different sectors of the economy.

Inflation Updates Ahead:

The Cleveland Fed’s latest nowcast models suggest upcoming inflation releases could offer some positive news for the Federal Open Market Committee (FOMC). Specifically, the Personal Consumption Expenditures Price Index, scheduled for update on May 31, is anticipated to show a modest monthly increase. Projections indicate this increase to range between 0.1% to 0.2%.

Such a moderate uptick in the PCE price index would likely be welcomed by FOMC officials, as it aligns with their objectives. These projections provide a glimpse into potential inflation trends, offering insights that could influence the FOMC’s decision making regarding monetary policy.

Looking ahead to the next Consumer Price Index (CPI) report for May, current nowcasts indicate expectations of a 0.1% monthly increase in headline inflation and a slightly higher 0.3% increase in core inflation.

If these projections hold true, it might not offer significant comfort to Federal Open Market Committee (FOMC) officials, but it does suggest that inflation remains relatively contained.

While the projected uptick in core inflation may raise some concerns for policymakers, the overall modest increase in both headline and core measures indicates a degree of stability in inflationary pressures.

These forecasts provide valuable insights into potential inflation trends, guiding policymakers as they navigate monetary policy decisions aimed at maintaining economic stability.

Future Meetings:

Given the relatively strong performance of the jobs market, the Federal Open Market Committee (FOMC) is adopting a cautious stance towards upcoming inflation data.

The committee seeks more evidence that inflation is progressing towards its target of 2% before considering any changes to monetary policy.

As a result, it’s widely anticipated that interest rates will remain unchanged at the Fed’s upcoming June meeting.

However, despite the FOMC‘s wait and see approach, fixed income markets are still pricing in the possibility of up to two interest rate cuts in 2024. This suggests that investors believe the Fed may ultimately decide to lower interest rates later in the year.

Today’s inflation data offers some positive signs, which could support the case for interest rate cuts further down the line.

These encouraging signals hint at potential downward pressure on interest rates as the year progresses. Although the timing and extent of any rate adjustments will ultimately depend on the evolving economic landscape and inflationary trends.

-

Soccer6 months ago

Soccer6 months agoDutch Fans in Blackface to Imitate Ruud Gullit, One Agrees to Stop

-

Soccer6 months ago

Soccer6 months agoEx Glamour Model Says Party with England Team Before Euros

-

News8 months ago

News8 months agoDubai Flood, Rain Turns Desert to Aquarium🌧️🐠

-

Soccer6 months ago

Soccer6 months agoArgentina vs Peru 2-0 Highlights & All Goals Copa America 2024

-

Entertainment7 months ago

Entertainment7 months agoThe Try Guys’ Journey From Four to Two

-

NBA6 months ago

NBA6 months agoCelebrate with the Boston Celtics: Parade and Traffic Updates

-

Soccer6 months ago

Soccer6 months agoUEFA EURO 2024: Essential Guide and Key Information

-

Soccer6 months ago

Soccer6 months agoVinicius Jr Scores Two Goals in Brazil’s Win Vs Paraguay in Copa America 2024

Pingback: Bridgerton 's Breakout Heroine Emerges in 3rd Season - Sports Groovy

Pingback: NVIDIA First Quarter Fiscal 2025, A Thrilling Financial Update - Sports Groovy