News

NVIDIA First Quarter Fiscal 2025, A Thrilling Financial Update

NVIDIA, a company that makes computer technology, said today that in the first three months of this year, it made $26.0 billion in revenue. That’s 18% more money than it made in the previous three months, and a whopping 262% increase from the same time last year.

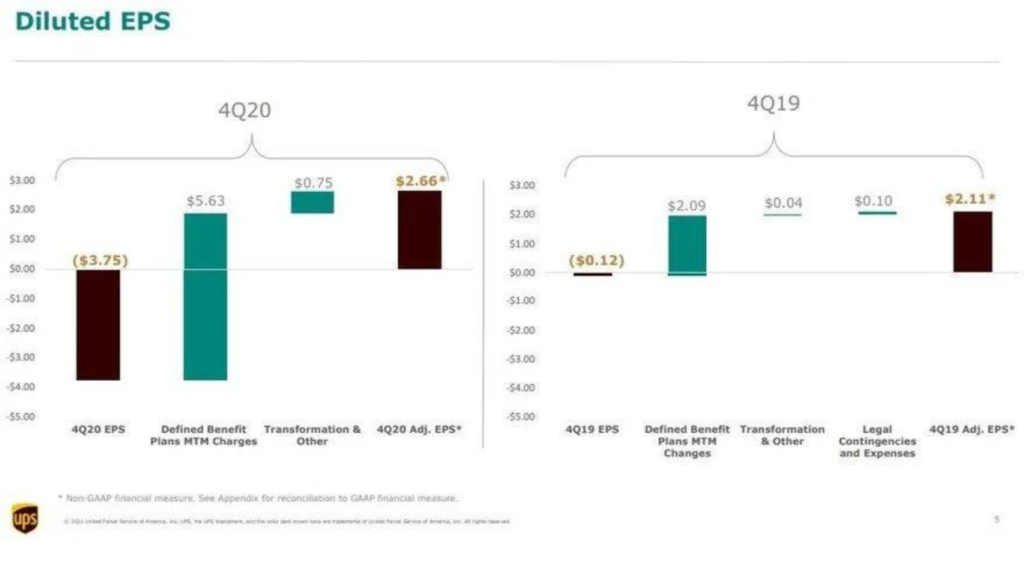

During this quarter, each share of NVIDIA’s stock earned $5.98 in profit, which is 21% higher than the previous quarter and a remarkable 629% increase from a year ago, based on standard accounting rules. But if we look at it without considering some extra factors. So, each share earned $6.12, up 19% from the last quarter and a 461% jump from a year ago.

Jensen Huang, who started NVIDIA and is its CEO, said that a big change is happening. While, Companies and even whole countries are teaming up with NVIDIA. They’re doing this to change the old-style data centers, which are worth trillions of dollars, into something new called accelerated computing. They want to create a different kind of data center, while, they’re calling “AI factories.” These factories will churn out something new artificial intelligence.

Huang thinks that AI will make a huge difference in how well businesses work. But it’ll help them save money and energy. Also, it’ll open up new chances to make more money.

Our data center business grew a lot because more and more people want to use our Hopper platform for generative AI training and inference. It’s not just big companies that provide cloud services anymore.

So, even smaller companies in the internet business, along with big corporations, governments, car companies, and healthcare firms, are all getting into generative AI. This is creating several new markets, each worth billions of dollars.

We’re ready for our next big growth phase. While, our Blackwell platform is up and running, and it’s the basis for taking generative AI to a whole new level with trillion-parameter scale. Spectrum-X is opening up a completely new market for us. It lets us bring large scale AI to data centers that also use only Ethernet connections.

And NVIDIA NIM is our new software. It made to run generative AI smoothly and efficiently wherever CUDA is available whether it’s in the cloud, on your own data center, or even on RTX AI PCs. We’ve teamed up with a bunch of partners to make this happen.

NVIDIA is making it easier for employees and also investors to own their stock by splitting each existing share into ten shares. This means if you have one share now, you’ll get nine more. The split will happen on June 7, 2024, also trading with the new split shares will start on June 10, 2024.

Also, they’re giving shareholders a bigger quarterly cash payment. Instead of 4 cents per share, they’ll now get 10 cents per share. This increase will start on June 28, 2024, and anyone who owns shares by June 11, 2024, will get it.

Quarter 1 Fiscal Year 2025 Highlights:

GAAP, the U.S. financial reporting standard for public companies, used to present the financial performance of NVIDIA.

Q1 FY25 Q4 FY24 Q1 FY24 Q/Q Y/Y Revenue $26,044 $22,103 $7,192 Up 18% Up 262% Gross margin 78.4% 76.0% 64.6% Up 2.4 pts Up 13.8 pts Operating expenses $3,497 $3,176 $2,508 Up 10% Up 39% Operating income $16,909 $13,615 $2,140 Up 24% Up 690% Net income $14,881 $12,285 $2,043 Up 21% Up 628% Diluted earnings per share $5.98 $4.93 $0.82 Up 21% Up 629%

For non-GAAP, which adjusts financial reporting to exclude certain items,

NVIDIA’s financial performance showcased differently.

Q1 FY25 Q4 FY24 Q1 FY24 Q/Q Y/Y Revenue $26,044 $22,103 $7,192 Up 18% Up 262% Gross margin 78.9% 76.7% 66.8% Up 2.2 pts Up 12.1 pts Operating expenses $2,501 $2,210 $1,750 Up 13% Up 43% Operating income $18,059 $14,749 $3,052 Up 22% Up 492% Net income $15,238 $12,839 $2,713 Up 19% Up 462% Diluted EPS $6.12 $5.16 $1.09 Up 19% Up 461%

NVIDIA’s Outlook for 2nd Quarter:

NVIDIA’s expectations for the second quarter of fiscal 2025 are outlined below:

- Revenue Outlook: NVIDIA anticipates revenue for the second quarter of fiscal 2025 to be around $28.0 billion, with a margin of error of plus or minus 2%.

- Gross Margin Expectations:

- GAAP Gross Margin: Expected to be approximately 74.8%.

- Non-GAAP Gross Margin: Expected to be around 75.5%.

- For the full fiscal year, gross margins are projected to remain in the mid-70% range.

- Operating Expenses Projections:

- GAAP Operating Expenses: Estimated to be roughly $4.0 billion.

- Non-GAAP Operating Expenses: Expected to be approximately $2.8 billion.

- Full-year operating expenses are forecasted to grow in the low-40% range.

- Other Income and Expense Expectations:

- Both GAAP and non-GAAP other income and expense are projected to be an income of approximately $300 million. This excludes gains and losses from non-affiliated investments.

- Tax Rate Forecasts:

- Both GAAP and non-GAAP tax rates are expected to be around 17%, with a margin of error of plus or minus 1%. This excludes any discrete items.

Data Center Highlights for the First Quarter:

- Record Revenue:

- First-quarter revenue reached a record $22.6 billion, marking a remarkable 23% increase from the previous quarter and a staggering 427% surge from the same period last year.

- Introduction of NVIDIA Blackwell Platform:

- NVIDIA unveiled the Blackwell platform, designed to power a new era of AI computing at a trillion-parameter scale. Additionally, the company introduced the Blackwell-powered DGX SuperPOD™ for generative AI supercomputing.

- Launch of NVIDIA Quantum and Spectrum X800 Series Switches:

- NVIDIA announced the NVIDIA Quantum and Spectrum X800 series switches for InfiniBand and Ethernet, respectively. These switches are optimized for trillion-parameter GPU computing and AI infrastructure.

- Introduction of NVIDIA AI Enterprise 5.0:

- NVIDIA launched NVIDIA AI Enterprise 5.0, featuring NVIDIA NIM inference microservices to accelerate enterprise application development.

- Development of NVIDIA cuLitho:

- NVIDIA announced the production collaboration with TSMC and Synopsys for NVIDIA cuLitho. This technology aims to expedite computational lithography, a crucial workload in semiconductor manufacturing.

- Adoption of Grace Hopper Superchips in Supercomputers:

- Nine new supercomputers globally integrated Grace Hopper Superchips, marking a significant advancement in AI supercomputing.

- Top Ranking on the Green500 List:

- Grace Hopper Superchips powered the top three machines on the Green500 list, showcasing NVIDIA’s commitment to energy-efficient supercomputing.

- Collaborations with Leading Cloud Providers:

- NVIDIA expanded collaborations with AWS, Google Cloud, Microsoft, and Oracle to drive innovation in generative AI.

- Partnership with Johnson & Johnson MedTech:

- NVIDIA collaborated with Johnson & Johnson MedTech to integrate AI capabilities aimed at supporting surgical procedures.

Non-GAAP Performance Metrics:

NVIDIA supplements its standard financial statements, prepared in accordance with GAAP, with non-GAAP measures to give investors a more comprehensive understanding of its financial performance. These additional metrics, such as non-GAAP gross profit and non-GAAP operating expenses, offer a different perspective on the company’s earnings and expenses.

To facilitate comparison with past periods, NVIDIA provides reconciliations between GAAP and non-GAAP financial measures. This reconciliation process adjusts GAAP figures to exclude certain expenses, like stock-based compensation and acquisition-related costs. It also factors in gains or losses from investments not directly affiliated with NVIDIA.

Furthermore, NVIDIA calculates free cash flow, a key indicator of financial health, by subtracting capital expenditures from operating cash flow. This metric helps investors gauge the company’s ability to generate cash after accounting for investments in property, equipment, and other assets.

While NVIDIA believes that presenting non-GAAP measures enhances investors’ understanding of its historical financial performance, it emphasizes that these metrics should not be viewed in isolation. Instead, they should be considered alongside GAAP results to get a complete picture of the company’s financial situation.

It’s worth noting that different companies may use varying non-GAAP measures, so investors should exercise caution when making comparisons. Overall, NVIDIA’s objective in presenting non-GAAP financial measures is to provide investors with a clearer view of its financial performance over time.

-

Soccer4 months ago

Soccer4 months agoDutch Fans in Blackface to Imitate Ruud Gullit, One Agrees to Stop

-

Soccer4 months ago

Soccer4 months agoEx Glamour Model Says Party with England Team Before Euros

-

Soccer4 months ago

Soccer4 months agoArgentina vs Peru 2-0 Highlights & All Goals Copa America 2024

-

News6 months ago

News6 months agoDubai Flood, Rain Turns Desert to Aquarium🌧️🐠

-

NBA4 months ago

NBA4 months agoCelebrate with the Boston Celtics: Parade and Traffic Updates

-

Soccer4 months ago

Soccer4 months agoUEFA EURO 2024: Essential Guide and Key Information

-

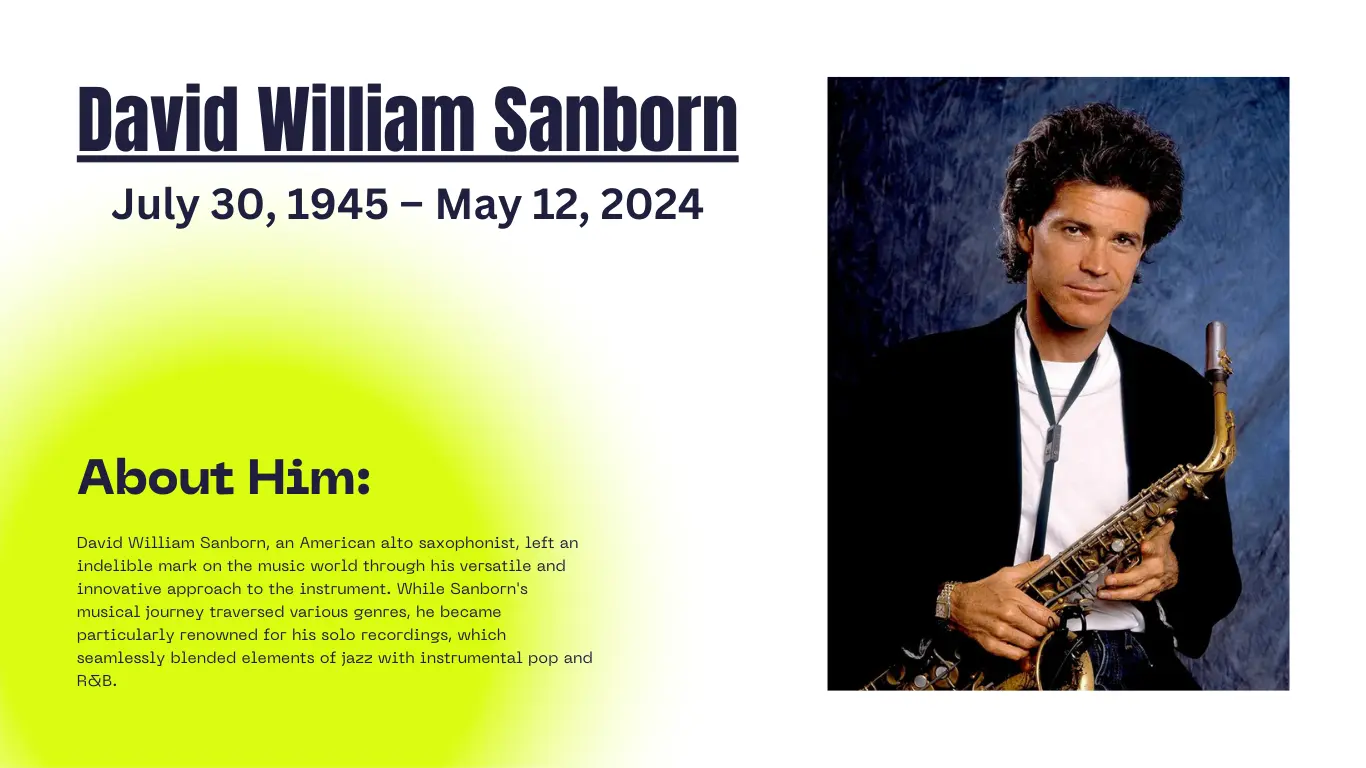

Celebrity5 months ago

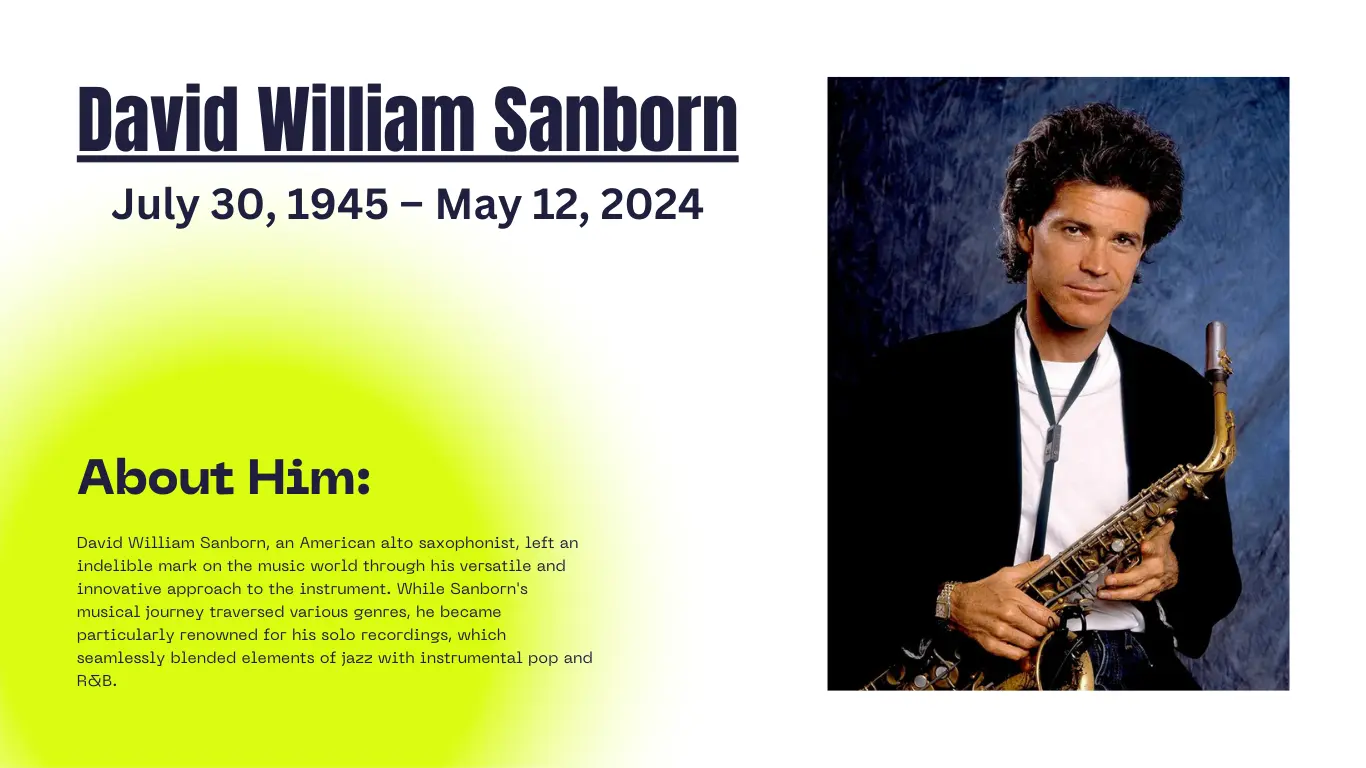

Celebrity5 months agoDavid Sanborn, American Alto Saxophonist, Died at Age 78

-

Entertainment5 months ago

Entertainment5 months agoThe Try Guys’ Journey From Four to Two

Pingback: Spice Up Your Day with San Antonio Savory Chilaquiles Fiesta - Sports Groovy

Pingback: Nvidia Growth Engine Revealing the Key Driver for Long Term Success - Sports Groovy