Celebrity

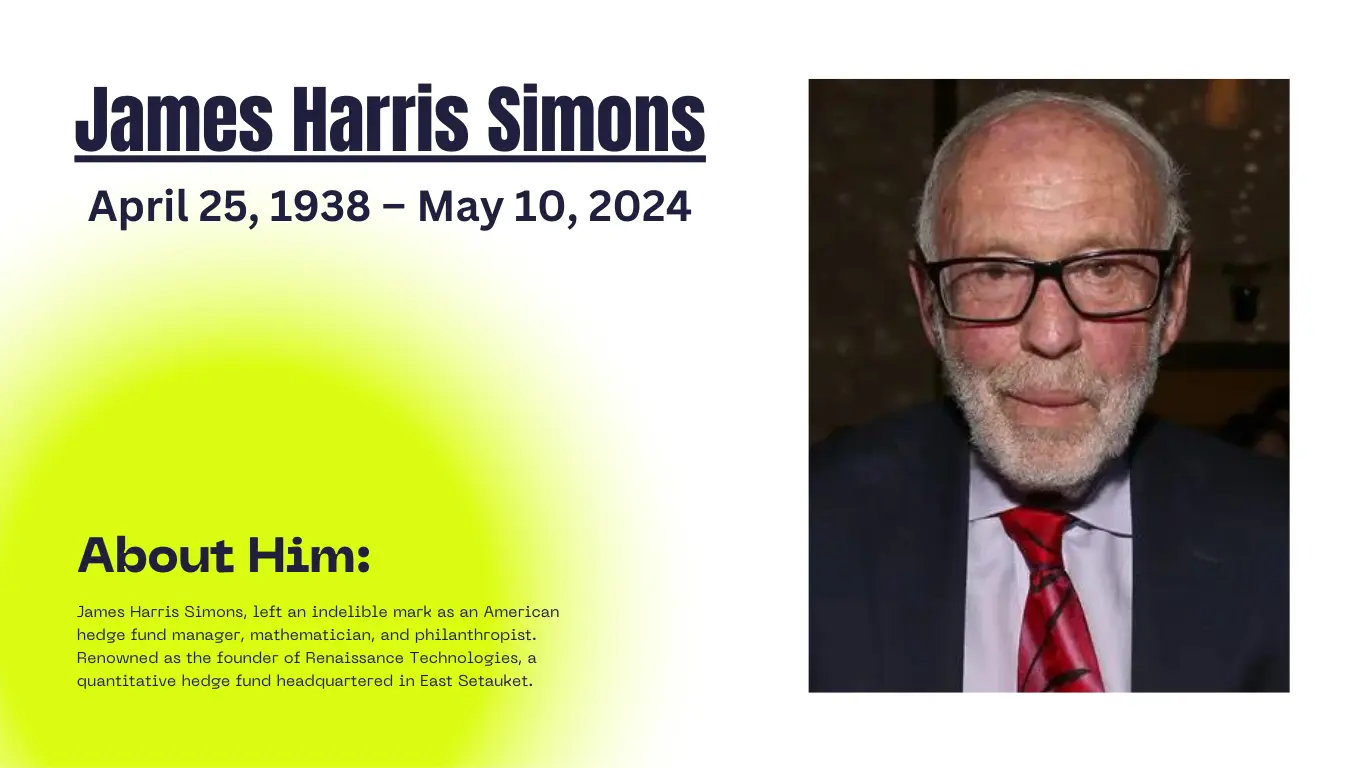

Quant King Jim Simons Dies At Age of 86

Jim Simons, a brilliant mathematician who changed the way people invest money, has passed away. He was 86 years old. He was not just a mathematician, but also the founder of a very successful hedge fund. This hedge fund used mathematical methods to trade stocks and other financial assets. It was one of the best performing hedge funds ever.

Rad Also: Another celebrity died last week in USA.

Jim Simons known for his work in a field called quantitative finance. This means using math and computer programs to make investment decisions. He started a company called Renaissance Technologies, which became famous for its success in the financial markets.

Sadly, Jim Simons passed away in New York City. His family announced his death on the website of his foundation.

His work has had a big impact on the finance world. Many investors now use mathematical models to guide their decisions, thanks in part to Jim Simons. He will remembered for his contributions to both mathematics and finance.

One of Simons’ most impressive achievements his flagship fund called the Medallion Fund. According to Gregory Zuckerman’s book “The Man Who Solved the Market,” this fund had amazing results. Between 1988 and 2018, it made an average return of 66% each year.

That’s a remarkable record, showing how effective Simons’ mathematical models and algorithms were at making money in the markets.

In 2023, according to the Bloomberg Billionaires Index, Jim Simons estimated to be worth $29.4 billion. This made him the 52nd wealthiest person globally. His success in finance had made him incredibly wealthy, putting him among the richest individuals in the world.

Jim Simons’ Business Career:

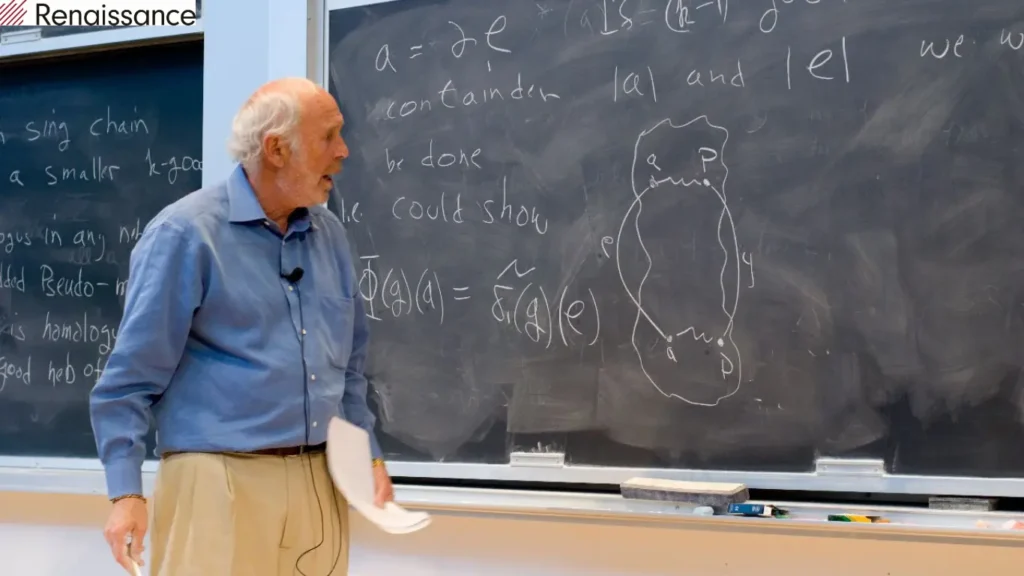

Jim Simons had a remarkable career in the world of business, particularly in finance. He started his journey as a mathematician, but his interest in applying mathematical models to the financial markets led him to establish Renaissance Technologies, a hedge fund management firm.

At Renaissance, Simons pioneered the use of quantitative trading strategies. Which rely on mathematical and statistical models to make investment decisions. So, these strategies involve analyzing vast amounts of data to identify patterns and trends in financial markets.

Simons’ innovative approach revolutionized the hedge fund industry and earned Renaissance a reputation for being one of the most successful firms in the field.

For over twenty years, Jim Simons’ Renaissance Technologies has been at the forefront of using mathematical models to trade in markets worldwide. So, their hedge funds rely on these models, which analyze and execute trades, with many of them automated.

Renaissance’s approach involves using computer based models to forecast price changes in various financial instruments. These models are built upon analyzing vast amounts of data, scouring through every bit of information available. Then, they search for patterns and trends that aren’t random, allowing them to make predictions about how prices will move.

By employing these sophisticated mathematical techniques, Renaissance Technologies has carved out a reputation for itself as a leader in quantitative trading. So, their success demonstrates the power of data analysis and automation in navigating the complexities of financial markets.

Since its establishment in 1988, the Medallion Fund, the primary fund managed by Renaissance Technologies, has achieved remarkable success. It has generated over $100 billion in trading profits. This translates to an average gross annual return of 66.1% or a net annual return of 39.1% between 1988 and 2018.

The Medallion Fund is unique in that it is closed to outside investors, meaning only employees of Renaissance Technologies can invest in it. So, this exclusivity has allowed the fund to focus on maximizing returns without the constraints of managing external capital.

In addition to the Medallion Fund, Renaissance Technologies manages three other funds: the Renaissance Institutional Equities Fund (RIEF), the Renaissance Institutional Diversified Alpha (RIDA) Fund, and the Renaissance Institutional Diversified Global Equity Fund. As of April 2019, these funds collectively held approximately $55 billion in assets and were open to outside investors.

These funds employ similar quantitative trading strategies as the Medallion Fund, leveraging mathematical models and algorithms to analyze market data and execute trades. While not as exclusive as the Medallion Fund, they have still attracted significant investment capital due to Renaissance Technologies’ track record of success in generating high returns.

Renaissance Technologies takes a unique approach to its workforce by hiring specialists from diverse backgrounds, not limited to finance. While, these include mathematicians, physicists, signal processing experts, and statisticians. By drawing talent from various fields, the firm can leverage a wide range of expertise to develop innovative trading strategies.

One of Renaissance’s latest funds is the Renaissance Institutional Equities Fund (RIEF). Unlike the exclusive Medallion Fund, RIEF is open to outside investors. However, historical performance data shows that RIEF has not matched the stellar returns of the Medallion Fund. Which is a separate fund containing only the personal investments of Renaissance’s executives.

Despite not reaching the same level of success as the Medallion Fund. RIEF still benefits from Renaissance’s quantitative trading strategies and the expertise of its diverse team. As a fund open to outside investors, RIEF provides an opportunity for individuals. As institutions to access Renaissance’s investment approach, albeit with potentially different performance outcomes compared to the exclusive Medallion Fund.

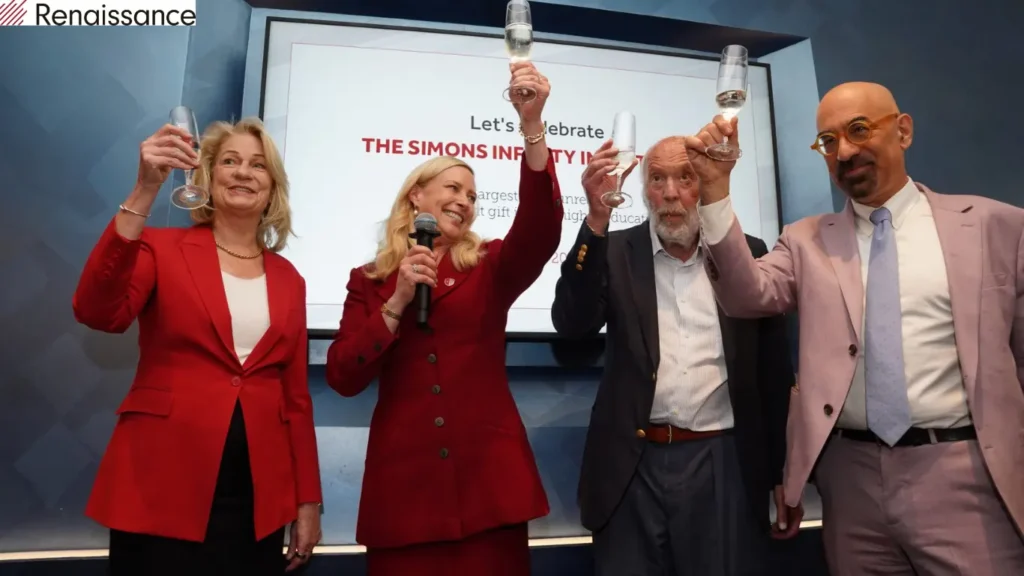

In 2006, Jim Simons was honored with the title of Financial Engineer of the Year. By the International Association of Financial Engineers. While he recognizing his significant contributions to the field of finance through his innovative use of mathematical models and algorithms.

Throughout his career, Simons amassed considerable personal wealth. In 2020, it was estimated that he earned $2.6 billion. While, this followed impressive earnings in previous years, including $2.8 billion in 2007, $1.7 billion in 2006. Further, $1.5 billion in 2005 (which marked the highest compensation among hedge fund managers that year), and $670 million in 2004.

Despite his immense success, Simons announced his retirement from his active role at Renaissance Technologies on October 10, 2009. However, he chose to remain involved with the company as a nonexecutive chairman after stepping down. This transition allowed him to continue contributing to the firm’s strategic direction. And oversight while also enjoying a more relaxed role in day-to-day operations.

Controversies Surrounding Jim Simons and Renaissance Technologies:

Investor Concerns: In May 2009, The Wall Street Journal reported that Jim Simons faced questioning. These questioning from investors regarding the significant performance gap observed across Renaissance Technologies’ portfolios.

At the center of these concerns was the stark contrast in performance between two of Renaissance’s key funds. The Medallion Fund and the Renaissance Institutional Equities Fund (RIEF).

The Medallion Fund, which had been exclusively available to current and former employees, as well as their families. As experienced an impressive surge of 80% in 2008, despite the imposition of substantial fees. This stellar performance stood in stark contrast to the losses incurred by the RIEF, which was owned by external investors. RIEF not only lost money in 2008 but also continued to decline in 2009, with a significant 16% drop recorded in 2008.

The discrepancy in performance between the Medallion Fund and RIEF raised eyebrows among investors. Which prompting questions about the factors contributing to these vastly different outcomes. Investors sought clarity on the strategies employed by Renaissance Technologies and the reasons behind the divergent performance of its funds.

The contrasting fortunes of these funds highlighted the complexities and risks inherent in the world of hedge fund investing. By underscoring the importance of transparency and accountability in managing investor expectations.

Tax Controversy: On July 22, 2014, Jim Simons found himself under bipartisan scrutiny by the U.S. Senate Permanent Subcommittee on Investigations due to the utilization of complex financial instruments known as basket options. These options were allegedly employed to shield the tax treatment of Renaissance Technologies’ day-to-day trading activities.

The Subcommittee, comprising members from both political parties, condemned Simons and Renaissance Technologies for exploiting these basket options to reclassify their day-to-day trading. Which is typically subject to higher ordinary income tax rates, as long-term capital gains. This reclassification enabled Renaissance Technologies to benefit from more favorable tax treatment on their trading activities.

During the hearing, Senator John McCain, the ranking Republican on the committee from Arizona. By highlighted the magnitude of tax avoidance facilitated by Renaissance Technologies. He stated, “Renaissance Technologies was able to avoid paying more than $6 billion in taxes by disguising its day-to-day stock trades as long-term investments,” emphasizing the significant financial impact of the alleged tax strategy.

The Subcommittee’s investigation shed light on the complexities of tax planning within the hedge fund industry. And raised concerns about the fairness and legality of certain tax avoidance practices. While, Simons and Renaissance Technologies faced widespread criticism for their alleged exploitation of tax loopholes to minimize their tax obligations. While sparking calls for greater regulatory scrutiny and oversight of tax planning strategies employed by financial institutions.

The controversy underscored the ongoing debate surrounding tax fairness and the need for comprehensive reforms to address loopholes and ensure equitable taxation practices across all sectors of the economy.

Tax Battle and Resolution: In 2015, The New York Times reported that Jim Simons and Renaissance Technologies were embroiled in one of the most significant tax battles of the year. The hedge fund firm came under scrutiny from the Internal Revenue Service (IRS) due to a loophole that allegedly allowed Renaissance to save an estimated $6.8 billion in taxes over approximately a decade.

The loophole in question involved complex financial maneuvers that reclassified short-term trading profits as long-term capital gains, which are typically taxed at lower rates. This tax-saving strategy drew attention from tax authorities, leading to an extensive review of Renaissance Technologies’ tax practices by the IRS.

In September 2021, it was announced that Jim Simons and his colleagues at Renaissance Technologies had reached a settlement with the IRS to resolve the longstanding tax dispute. As part of the agreement, Simons and his associates agreed to pay billions of dollars in back taxes, interest, and penalties, marking one of the largest settlements in IRS history.

The resolution of the tax dispute brought an end to years of legal battles and uncertainty for Simons and Renaissance Technologies. However, it also underscored the regulatory challenges and complexities surrounding tax planning in the financial industry.

The case highlighted the importance of tax compliance and transparency in navigating tax regulations and avoiding potential legal pitfalls. Simons’ involvement in the high-profile tax battle served as a reminder of the scrutiny faced by wealthy individuals and corporations regarding their tax obligations, and the consequences of non-compliance with tax laws.

Legacy and Awards of Jim Simons:

Jim Simons, a titan in the worlds of mathematics and finance, amassed a legacy defined by groundbreaking achievements and prestigious accolades. Throughout his illustrious career, Simons garnered recognition for his unparalleled intellect, innovative contributions to quantitative trading, and transformative impact on the financial industry. From being hailed as “the world’s smartest billionaire” to his induction into esteemed halls of fame, Simons’ awards and accolades reflect his enduring legacy as a visionary leader and pioneer in quantitative finance.

- Institutional Investors Alpha’s Hedge Fund Manager Hall of Fame (2008): Recognized for his exceptional contributions to the hedge fund industry.

- Named “the world’s smartest billionaire” by the Financial Times (2006): Acknowledged for his remarkable intellect and success in finance.

- Elected to the American Philosophical Society (2007): Honored for his significant achievements in mathematics and finance.

- Included in the 50 Most Influential ranking of Bloomberg Markets Magazine (2011): Recognized for his profound impact on global financial markets.

- Recipient of an honorary doctorate from Trinity College Dublin (2018): Awarded for his significant contributions to academia and finance.

- Subject of the book “The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution” by Gregory Zuckerman (2019): A biography documenting Simons’ life and pioneering work in quantitative trading, cementing his legacy in the finance world.

-

Soccer4 months ago

Soccer4 months agoDutch Fans in Blackface to Imitate Ruud Gullit, One Agrees to Stop

-

Soccer4 months ago

Soccer4 months agoEx Glamour Model Says Party with England Team Before Euros

-

Soccer4 months ago

Soccer4 months agoArgentina vs Peru 2-0 Highlights & All Goals Copa America 2024

-

News6 months ago

News6 months agoDubai Flood, Rain Turns Desert to Aquarium🌧️🐠

-

NBA4 months ago

NBA4 months agoCelebrate with the Boston Celtics: Parade and Traffic Updates

-

Soccer4 months ago

Soccer4 months agoUEFA EURO 2024: Essential Guide and Key Information

-

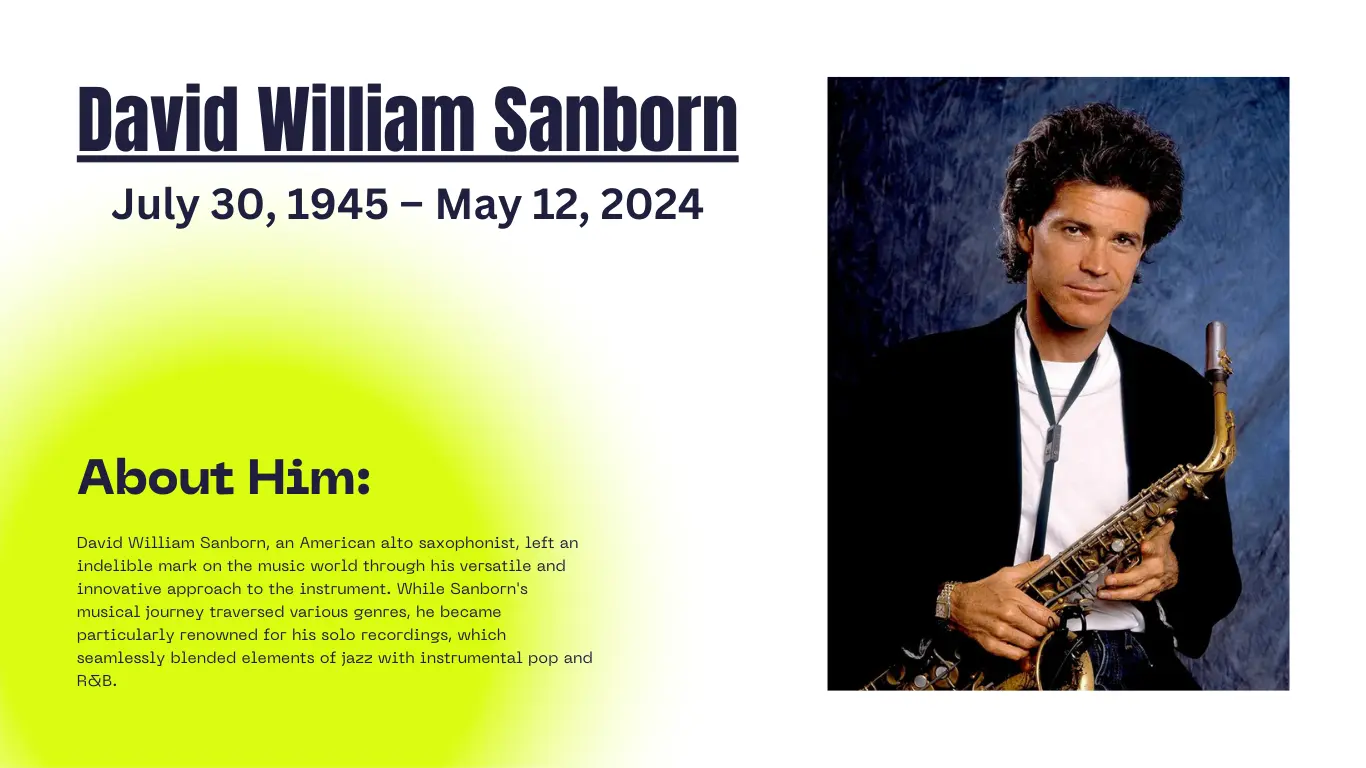

Celebrity5 months ago

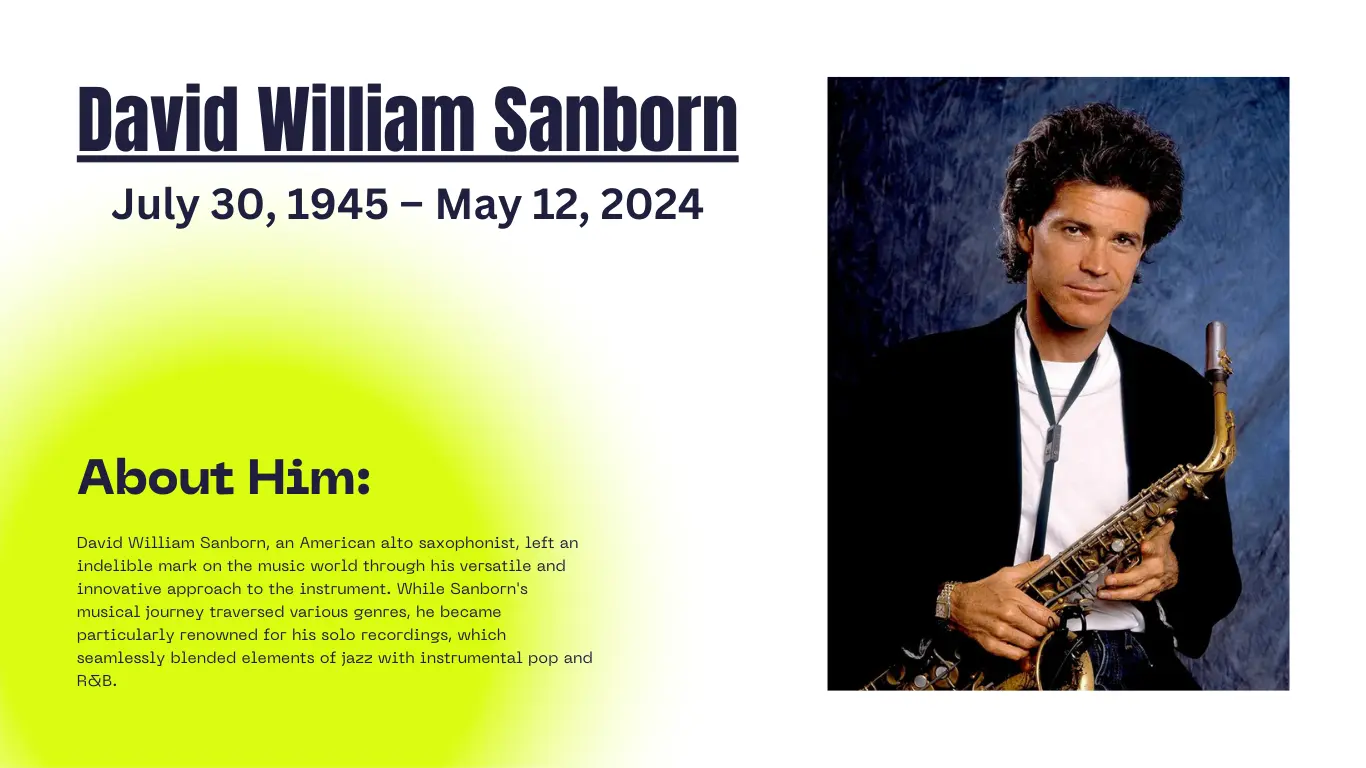

Celebrity5 months agoDavid Sanborn, American Alto Saxophonist, Died at Age 78

-

Entertainment5 months ago

Entertainment5 months agoThe Try Guys’ Journey From Four to Two

Pingback: Beloved KTLA Entertainment Anchor, Sam Rubin, Dies at 64 - Sports Groovy

Pingback: Denver Nuggets Dominate Minnesota Timberwolves in Game 3 Showdown - Sports Groovy