News

GameStop Skyrockets 70% as ‘Roaring Kitty’ Returns to Drive Meme Craze

GameStop’s stock went up a lot on Monday. This happened because ‘Roaring Kitty’ the person who helped cause the big jump in GameStop’s stock in 2021, posted something online for the first time in about three years.

The post was a picture on X, a social media platform, showing a video gamer leaning forward on their chair, looking very focused on the game they’re playing. This picture was the first thing ‘Roaring Kitty’ shared on X or Reddit since 2021.

In just 13 hours, the post got 63,000 likes, showing that a lot of people interested in what ‘Roaring Kitty’ had to say after such a long time.

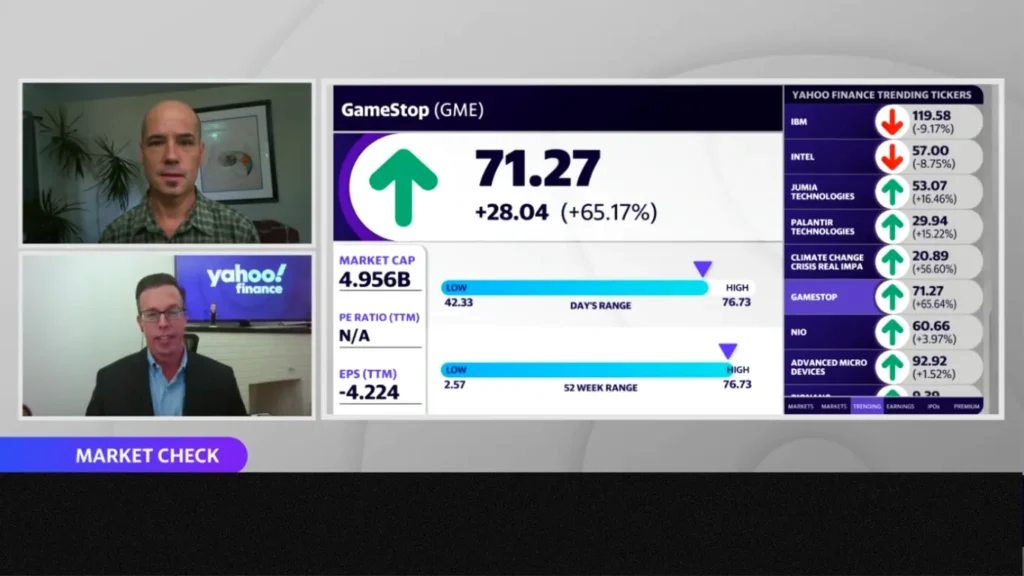

GameStop’s stock went up by 77% after it had surged as high as 110% at one point. The trading of GameStop’s stock stopped several times because it was changing so much, which called volatility.

Another stock that became famous because of online discussions, AMC, also went up by 75% on Monday. Additionally, Reddit, a popular social media platform where people often talk about stocks, saw its own stock price increase by 9%.

It was a day of big movements for these stocks that have gained attention because of discussions on the internet.

Roaring Kitty, whose real name is Keith Gill, used to work in marketing for Massachusetts Mutual Life Insurance. Roaring Kitty also known as Deep Value on Reddit. Gill became well known for gathering a group of day traders who supported each other and invested heavily in GameStop. A traditional video game retailer with physical stores. They also bought lots of options to buy GameStop stock at a certain price, known as call options.

This all happened between 2020 and 2021, and it caught a lot of attention. Because of how much the stock price went up and the excitement among the traders.

During the “meme stock” frenzy, regular people who invest on their own targeted short sellers and hedge funds. These short sellers and hedge funds were betting that the stock prices of companies like GameStop would go down.

But the individual investors, often working together online, bought a lot of these stocks, making it harder for the short sellers and hedge funds. This forced those short sellers and hedge funds to buy back the stocks they borrowed. Which called covering their short positions. This increased demand drove up the prices of these stocks even more.

Currently, the short position in GameStop shares meaning the number of shares that have borrowed. And sold with the hopes of buying them back at a lower price is more than 24% of all the shares of GameStop. That is available to traded openly.

This situation, where so many shares are bet against, can add to the volatility and uncertainty surrounding the stock. It’s a big part of why GameStop’s stock has been so unpredictable lately.

Afterwards, Roaring Kitty shared several videos featuring clips from well known TV shows and movies. However, the meaning behind these videos isn’t immediately clear.

On Monday, GameStop emerged as the dominant topic on Reddit’s WallStreetBets forum, far surpassing mentions of other popular stocks. In the last 24 hours alone, there were over 600 discussions about GameStop. Which making it the most talked about stock on the forum during that period.

This surge in discussion exceeded even that of Nvidia, a widely recognized chipmaker. According to data from Quiver Quantitative, a market research platform. The intense focus on GameStop within the online investment community highlights the ongoing fascination and speculation surrounding the company’s stock.

Melvin Capital found itself in the crosshairs of the WallStreetBets traders. The hedge fund had taken a significant position betting against GameStop’s stock, essentially betting that its price would fall.

However, this move made them a prime target for the army of amateur traders who were rallying behind GameStop. As a result, Melvin Capital incurred substantial losses.

To help stabilize Melvin Capital’s finances in the face of these losses, Ken Griffin’s Citadel. Along with Point72, stepped in to provide support. Together, they injected nearly $3 billion into Melvin Capital.

This financial backing, known as a backstop, aimed to shore up Melvin Capital’s resources. And help mitigate the impact of its losses from the GameStop situation. The involvement of such major players in providing financial support underscores the significant impact. That the GameStop frenzy had on the broader financial landscape.

Short selling is a tactic used by investors where they borrow shares of a stock at a specific price. With the expectation that the stock’s market value will drop below that level by the time they need to return the borrowed shares.

The GameStop frenzy that catapulted its stock price to over $120 per share, adjusted for splits. Within just three months from a mere $3 per share caught the attention of the entire financial world. This surge in price driven by a wave of enthusiasm from individual investors. Many of whom congregated on platforms like Reddit’s Wall Street Bets.

As GameStop’s stock price soared, brokerages such as Robinhood found themselves in a difficult position. They faced immense pressure to curb the trading of heavily shorted stocks, including GameStop. Due to the volatility and potential risks involved. In response, Robinhood and other platforms imposed restrictions on trading certain stocks, including GameStop.

This decision by Robinhood sparked outrage among its users, leading to a class action lawsuit filed by one of its users. The lawsuit alleged that Robinhood’s decision to limit trading in GameStop unfairly disadvantaged investors. However, in August 2023, the lawsuit was dismissed, bringing an end to the legal battle.

The events surrounding GameStop’s meteoric rise and the subsequent trading restrictions highlighted the power dynamics. Between individual investors, institutional investors, and trading platforms in today’s financial markets. It also raised questions about market manipulation, transparency, and the role of technology in shaping investment behavior.

Another class-action lawsuit targeted Roaring Kitty, accusing him of pretending to be an inexperienced trader despite holding a professional license in the financial industry.

The extreme volatility witnessed during the GameStop saga led to a series of congressional hearings focusing on the practices of brokerage firms and the trend of making retail trading resemble a game.

Testimony was given by key figures from various entities involved, including Robinhood, Melvin Capital, Reddit, Citadel, and Roaring Kitty himself. These hearings aimed to shed light on the events surrounding the GameStop frenzy and assess the impact on financial markets and investors.

The culmination of these events was the release of the 2023 movie titled “Dumb Money,” which depicted the GameStop saga. In the film, actor Paul Dano portrayed Gill, bringing the story to life on the big screen.

The movie served as a dramatized retelling of the events, offering viewers a glimpse into the complexities and controversies surrounding the GameStop phenomenon.

Overall, the GameStop saga sparked widespread discussion and scrutiny of Wall Street practices, retail trading dynamics, and the influence of online communities on financial markets. It served as a catalyst for regulatory scrutiny and prompted a broader conversation about investor protection and market integrity.

In January 2021, GameStop shares reached an all time high of $120.75 during the trading day. This price is adjusted to account for a subsequent 4-for-1 stock split that occurred in the summer of 2022.

However, as interest from individual investors began to wane, the stock’s value declined, along with other meme stocks like AMC Entertainment Holdings. In fact, GameStop hit a low point last month, dropping to $9.95 per share, the lowest it had been in three years.

Recently, there has been renewed movement in GameStop’s stock price, which may have reignited Keith Gill’s interest, along with the significant amount of short interest in the company.

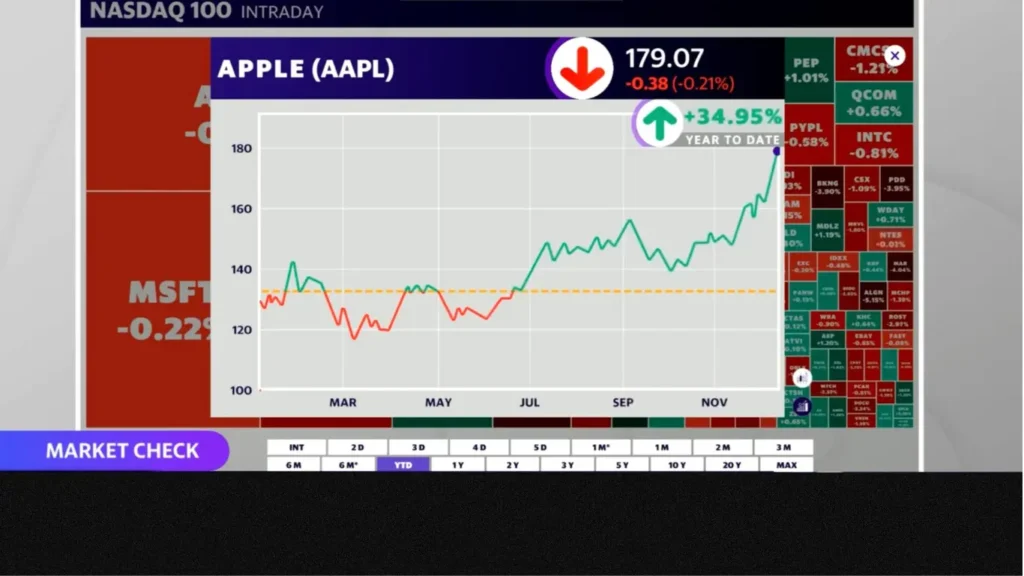

In May, GameStop’s stock has surged by 57%, showing a notable increase in value. As of Friday’s closing, GameStop was trading at $17.46 per share. This resurgence in the stock’s price could be attracting attention from investors like Gill, who closely follow developments in the market.

Despite the recent surge in its stock price, GameStop’s underlying business fundamentals paint a less optimistic picture for the video game company. This was evident in its most recent earnings report.

In late March, GameStop announced that it had implemented job cuts as part of its efforts to lower costs. The exact number of jobs affected was not specified.

Additionally, the company reported a decline in revenue for the fourth quarter of its fiscal year. This decrease in revenue was attributed to increased competition from e-commerce-based rivals.

For the fiscal fourth quarter, GameStop posted revenue of $1.79 billion. This figure represents a notable decrease from the $2.23 billion in revenue reported for the same quarter in the previous year. The decline in revenue highlights the challenges faced by GameStop in maintaining its market position amid a changing retail landscape and heightened competition from online retailers.

-

Soccer5 months ago

Soccer5 months agoDutch Fans in Blackface to Imitate Ruud Gullit, One Agrees to Stop

-

Soccer5 months ago

Soccer5 months agoEx Glamour Model Says Party with England Team Before Euros

-

News7 months ago

News7 months agoDubai Flood, Rain Turns Desert to Aquarium🌧️🐠

-

Soccer5 months ago

Soccer5 months agoArgentina vs Peru 2-0 Highlights & All Goals Copa America 2024

-

NBA5 months ago

NBA5 months agoCelebrate with the Boston Celtics: Parade and Traffic Updates

-

Soccer5 months ago

Soccer5 months agoUEFA EURO 2024: Essential Guide and Key Information

-

Soccer5 months ago

Soccer5 months agoVinicius Jr Scores Two Goals in Brazil’s Win Vs Paraguay in Copa America 2024

-

Entertainment6 months ago

Entertainment6 months agoThe Try Guys’ Journey From Four to Two

Pingback: Introducing GPT-4o, OpenAI's Latest Breakthrough in AI Technology - Sports Groovy

Pingback: Red Lobster Restaurant is closing nearly 50 locations in Florida Due To Bankruptcy - Sports Groovy