News

Fulton Bank Surprises Everyone by Buying Republic First Bank

The recent action is a sign of more problems in the struggling regional banking sector. On Friday night, Philadelphia’s Republic First Bank got shut down by state regulators. The Federal Deposit Insurance Corp., or FDIC, announced this news.

Republic First Bank, based in Pennsylvania, also known as Republic Bank, is a small bank. It got taken over by regulators on Friday. They sold off most of its stuff, like what it owns and owes, to another bank called Fulton Bank.

After facing significant challenges due to increased interest rates. Republic First Bancorp received a lifeline on Friday from a fellow Pennsylvania based bank, Fulton Financial Corp. The struggles of Republic First Bancorp, a regional lender, came to a head. As it grappled with the impact of rising interest rates on its operations. The pressure mounted as the cost of borrowing increased, squeezing margins and hindering profitability.

In a bid to address its mounting difficulties, Republic First Bancorp sought assistance from another player in the regional banking arena. Fulton Financial Corp, recognizing the potential synergies and opportunities for collaboration, stepped in to offer support.

The decision to extend a helping hand to Republic First Bancorp reflects Fulton Financial Corp’s commitment to the local banking community. Its willingness to assist fellow institutions facing challenges.

For Republic First Bancorp, the partnership with Fulton Financial Corp provides a much needed lifeline. By aligning with a stronger and more stable institution, Republic First Bancorp gains access to resources, expertise, and support systems. That can help navigate the turbulent waters ahead.

This strategic alliance not only safeguards the interests of Republic First Bancorp’s customers and stakeholders. But also paves the way for a more sustainable and resilient future.

The collaboration between Republic First Bancorp and Fulton Financial Corp underscores. The importance of solidarity and cooperation within the banking industry, particularly during times of adversity. By pooling resources and expertise, institutions can weather storms more effectively and emerge stronger on the other side.

As Republic First Bancorp embarks on this new chapter with Fulton Financial Corp by its side. The focus shifts towards leveraging synergies, driving operational efficiencies, and charting a path towards sustainable growth. While challenges may persist, the partnership between these two Pennsylvania based banks serves as a beacon of hope and resilience in an ever evolving financial landscape.

In a significant development late Friday, Fulton Financial announced that its subsidiary. Fulton Bank, had completed the acquisition of “substantially all of the assets. It had taken over “substantially all of the deposits” of Republic First, a Philadelphia based bank.

Republic First, known for operating 32 bank branches across Pennsylvania, New Jersey, and New York under the name Republic Bank. Which found itself at the center of this acquisition deal.

The acquisition marks a strategic move by Fulton Financial to expand its footprint and strengthen its presence in key markets. By acquiring the assets and deposits of Republic First, Fulton Bank gains access to a broader customer base and a wider geographical reach.

This expansion aligns with Fulton Financial growth strategy and positions the bank for enhanced competitiveness in the regional banking landscape.

For Republic First, the acquisition represents a significant transition as its operations are absorbed by Fulton Bank. With the transfer of assets and deposits, Republic First customers can expect continuity in banking services under the Fulton Bank brand.

The acquisition also provides assurance to Republic First’s depositors, ensuring the safety and security of their funds under the FDIC-insured umbrella of Fulton Bank.

The integration of Republic First’s assets and deposits into Fulton Bank’s operations will require careful planning and execution. Fulton Financial will need to streamline processes, harmonize systems, and ensure a seamless transition for customers and employees alike.

As Fulton Financial moves forward with the integration process, both organizations will work collaboratively to capitalize on synergies, drive efficiencies, and unlock value for stakeholders. The acquisition of Republic First by Fulton Bank signifies a new chapter in the evolution of both institutions, characterized by growth, resilience, and a shared commitment to serving the needs of their communities.

With Fulton Bank now at the helm, the legacy of Republic First will continue to thrive, albeit under a new banner, as part of a larger, more robust banking entity. As customers and employees transition to the new operating environment. The focus remains on delivering exceptional service, fostering innovation, and driving sustainable growth in the years to come.

Fulton purchased Republic First Bank in an auction organized by the Federal Deposit Insurance Corporation (FDIC). This happened after banking regulators in Pennsylvania took control of the struggling bank earlier on Friday. The Wall Street Journal reported this news.

On Friday evening, the FDIC issued a statement explaining that state regulators had put them in charge of Republic First Bank. They said that they had reached an agreement with Fulton Bank to safeguard the interests of depositors. The FDIC mentioned that Republic First’s failure marked the first bank collapse in the United States this year.

The announcement marks another problem for the struggling regional banking sector, with Republic First being the latest to face difficulties. However, compared to other banks that have collapsed or come close to it since last year, Republic First was relatively small.

The Journal reported on Friday that rising interest rates in the industry have led to a decline in the value of bonds for some banks, including Republic First. Additionally, the troubled market for commercial real estate, particularly in the office sector, has added to the challenges for other banks. This has raised worries that depositors might start pulling their money out of these financial institutions.

Fulton, headquartered in Lancaster, Pennsylvania, and holding assets totaling around $27 billion, revealed that it had acquired assets valued at roughly $6 billion through the transaction. This included Republic First’s investment portfolio of approximately $2 billion and loans totaling around $2.9 billion.

The company also stated that it had taken on liabilities amounting to about $5.3 billion. These liabilities comprised deposits totaling approximately $4 billion, along with other borrowings and liabilities amounting to roughly $1.3 billion.

Fulton assured Republic Bank depositors that they would still be able to access their accounts through online banking, writing checks, and using ATMs and debit cards. These customers would become part of Fulton’s depositor base and wouldn’t need to make any changes to maintain their federally insured deposit-insurance coverage, according to the company.

Fulton further announced that starting as soon as Saturday, former Republic Bank branches would reopen under the Fulton Bank name. The company also stated that it would host a conference call on Monday morning to provide additional information about the transaction.

This move will expand Fulton’s footprint along the East Coast. Fulton Bank currently operates at over 200 locations across Pennsylvania, New Jersey, Maryland, Delaware, and Virginia. In a statement, Fulton’s Chief Executive, Curt Myers, expressed that the deal would effectively double their presence across the region.

After hours on Friday, Fulton’s shares (FULT) surged by 10%, while Republic First’s shares (FRBK) closed at roughly one cent per share before the announcement.

Earlier on Friday, The Wall Street Journal covered the seizure and impending sale of Republic First by regulators. Last year, the bank dodged an auction by the FDIC by securing a $35 million capital injection from an investor.

However, this arrangement fell through earlier this year. Bloomberg reported on Wednesday that the FDIC was in talks with potential buyers for the bank.

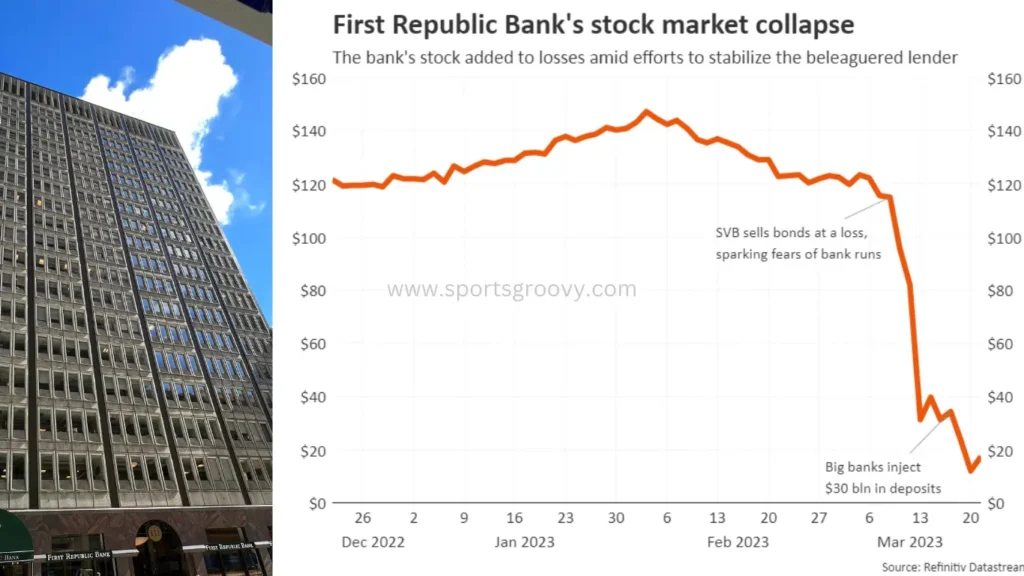

The bailout of Republic First comes after a string of failures last year involving significantly larger regional banks such as Silicon Valley Bank and Signature Bank. First Republic Bank, which was also facing difficulties, was acquired by JPMorgan Chase & Co. (JPM) last year.

This year, New York Community Bancorp. (NYCB) has faced similar challenges. The bank has been grappling with its exposure to the struggling commercial real estate market. To survive, it has been navigating through a significant sell off of its stocks.

Reasons Behind Republic First Bank’s Failure:

Republic First’s failure marks the first time an FDIC-insured institution has collapsed in the U.S. in 2024. The last bank to fail was Citizens Bank, headquartered in Sac City, Iowa, back in November 2023.

Typically, in a strong economy, only about four or five banks shutter each year. However, the landscape has been challenging lately. Rising interest rates and declining commercial real estate values, particularly for office spaces dealing with high vacancy rates post-pandemic, have increased financial risks for many regional and community banks. Loans tied to properties that have lost value pose challenges for refinancing.

Last month, a group of investors led by Steven Mnuchin, who previously served as the U.S. Treasury secretary under the Trump administration, committed over $1 billion to rescue New York Community Bancorp. This move came as the bank struggled with weaknesses in the commercial real estate sector and operational challenges stemming from its acquisition of a distressed bank.

Republic First’s rescue comes after a string of failures among larger regional banks last year, including Silicon Valley Bank and Signature Bank. First Republic Bank, also facing difficulties, was acquired by JPMorgan Chase & Co. in the same period. This year, New York Community Bancorp has faced similar hurdles, grappling with exposure to the troubled commercial real estate market and navigating through a significant sell-off of its stocks.

-

Soccer5 months ago

Soccer5 months agoDutch Fans in Blackface to Imitate Ruud Gullit, One Agrees to Stop

-

Soccer5 months ago

Soccer5 months agoEx Glamour Model Says Party with England Team Before Euros

-

News7 months ago

News7 months agoDubai Flood, Rain Turns Desert to Aquarium🌧️🐠

-

Soccer5 months ago

Soccer5 months agoArgentina vs Peru 2-0 Highlights & All Goals Copa America 2024

-

NBA5 months ago

NBA5 months agoCelebrate with the Boston Celtics: Parade and Traffic Updates

-

Soccer5 months ago

Soccer5 months agoVinicius Jr Scores Two Goals in Brazil’s Win Vs Paraguay in Copa America 2024

-

Soccer5 months ago

Soccer5 months agoUEFA EURO 2024: Essential Guide and Key Information

-

Entertainment6 months ago

Entertainment6 months agoThe Try Guys’ Journey From Four to Two

Pingback: Eagles Fans Cheer as Team Picks Jeremiah Trotter Jr. - Sports Groovy